Many businesses claim to offer excellent customer service, but only a few stand out for genuinely exceptional customer service. You’re about to find out the processes and methods some of the world’s most successful brands use to deliver above-average customer service. Before revealing those secrets, let’s answer a question you’re probably thinking about right now:

Why Focus On Improving Customer Service?

A significant amount of industry research has found high levels of customer service lead to more successful businesses.

- Increase Profits. A 5% increase in customer retention in financial services products more than a 25% increase in profit, according to Bain & Company. Improving the quality of customer service is one way to boost customer retention.

- Several Industries Have A Customer Service Opportunity. Several industries have low customer satisfaction scores. For example, the airline industry has a 75 score according to the American Customer Satisfaction Index. The video-on-demand industry has an average score of 68 according to the same index. As a result, companies in those industries that invest in better customer service will have an easier chance of overtaking their competitors.

How To Use These Customer Service Secrets

Improving customer service doesn’t have to be painful. Review these case studies from both large and small businesses and look for inspiration to adapt to your company. Remember, you can constantly adapt ideas from other industries. For example, Steve Jobs took inspiration from kitchen appliances to inform Apple’s design approach, according to Fast Company.

American Express: Exceptional Customer service during the COVID-19 pandemic

Delivering high-quality customer service in the good times is one thing. Sustaining outstanding service during a global pandemic is another challenge altogether. That’s why American Express is impressive.

The credit card company was the top-ranked national card issuer in the 2020 J.D. Power U.S. Credit Card Satisfaction Study. The company’s high customer service is driven by several key factors. The company offers a financial relief program to allow customers to make lower monthly payments and avoid penalties. In addition, the company committed $200 million to help hard-hit businesses through the Shop Small campaign. Finally, the company rolled out a “Freeze Card” feature on its mobile app so that customers can stop purchases if they lose track of their American Express card.

Learn from the American Express example by changing your customer service practices when times are tough for your customer. For example, look for ways to offer payment flexibility or empower them to use the product more effectively.

Rolex: Creating Confidence with a Service Guarantee

Rolex has a unique status as a luxury brand in the watch industry. At the low end, a pre-owned Rolex watch can sell for approximately $4000 while brand new watches have a much higher price.

Several factors contribute to the watch company’s outstanding reputation. Customer service is part of the package. First, the company offers the “Rolex guarantee: Rolex guarantees the proper functioning of its watches for five years from the date of purchase. By setting expectations upfront, the company reassures customers that their watch will stay working for years.

Rolex also stands out from the competition because it explains the Rolex servicing procedure in detail. There is less anxiety about sending a multi-thousand watch in for servicing by explaining the step-by-step customer service process.

The lesson from Rolex is two-fold. Start with the company’s customer service guarantee. If you are confident in your products’ quality, prove it by offering a multi-year guarantee. Next, think about revealing your customer service procedures to the public like Rolex. This might feel scary if you have never disclosed information like that before, but Rolex shows it can be done.

Hilton Wins Recognition For Its Reward Program

Maintaining high levels of customer service for travelers around the world isn’t easy. Yet, Hilton Hotels has managed to achieve just that. In 2020, the global hotel business won the FlyerTalk Awards for the second year running. Specifically, the company earned recognition for its customer loyalty program beating dozens of competing loyalty programs. In addition, Hilton won recognition for the quality of its breakfast program.

Offering a customer loyalty or rewards program is a long-established practice. Yet, the details make a critical difference. Hilton has invested in creating a contactless digital key in its app, for example. Further, the company provided greater flexibility in reward redemption due to travel disruptions in 2020.

The customer service lesson from Hilton is simple. Take an existing part of your customer experience, like rewards, and look for ways to make those programs better for customers. Can you offer customers more choices in how and when they do business with you? Can you make your rewards and loyalty programs more flexible?

Disney eliminates customer service problems before they happen

Over the past year, Disney has earned attention for its highly successful Disney+ streaming service. It is helpful to keep in mind that digital services are just part of the Disney business model. Hotels, theme parks, and cruises are other critical parts of the Disney experience. Those parts of the business have customer service lessons for all of us.

Disney took a different approach to the theme park industry from the beginning. Walt Disney set a rule that guests should not have to walk more than thirty feet to a trash can. In recent years, the average distance to a trash can fell to less than thirty feet. As a result, the company ended up installing a large number of trashcans which helps the parks to improve cleanliness.

Aside from trash, the company also takes extensive measures to detect and prevent mosquitos from harassing guests in Florida. For example, the company has a mosquito surveillance program that includes surveillance chickens!

There’s much more to the Disney customer experience we haven’t touched on, but these two examples are easy to apply. Take pride in your company’s physical spaces and keep them clean. In the short term, a strong focus on cleaning can help to prevent the spread of disease.

If cleanliness is not a top concern for your business, there’s a different way to apply Disney’s customer service secret. Invest time and resources into processes and equipment that cause customer complaints or discomfort.

DHL wins with customer onboarding and mystery shopping

DHL operates in a highly competitive shipping and logistics market. Despite competing against well-established brands like FedEx and UPS, DHL has distinguished itself through customer service.

As of 2019, the logistics company has won eight Stevie® Awards for customer service. In particular, the company has won recognition for developing a customer onboarding program. As a result, the company has eliminated time-consuming back-and-forth emails with new customers.

DHL is also focused on improved the customer experience for its existing customers. The company uses a mystery shopping program to improve the way it quotes rates and related processes.

Thinking in terms of the entire customer lifecycle is the key lesson from DHL. Look at the processes, forms, and activities involved in onboarding a new customer. Look for ways to make that new customer experience faster or easier. Finally, consider using a mystery shopping process (i.e., calling your company and pretending to be a customer) to detect possible gaps in the experience.

How Agiloft wins with a 90 day satisfaction guarantee

Based in California, Agiloft offers process management software. As a smaller company, the business has to make thoughtful decisions on where to compete. For several years, the business has focused on customer service quality and won.

In 2019, the company won the 2019 Excellence in Customer Service Award from Business Intelligence Group. The company won the award by making several significant commitments in customer service. First, the company has provided a same-day response to customer inquiries that came in during business hours. Further, the business also provides a ninety-day satisfaction guarantee to customers. If a new customer is not satisfied for any reason in their first 90 days using the product, they can request a refund. Ultimately, the company has only had three refund requests out of hundreds of customers.

Some companies might feel nervous about offering a ninety-day refund guarantee. Fortunately, Agiloft shows that refund requests tend to be relatively low. If a business already has a high customer satisfaction rate, consider making a public pledge. For example, if your business has the lowest error rate in your industry, consider making a promise about your commitment to errors.

The One Change That Always Improves The Customer Experience

Across all of the industries and companies we’ve studied, there is one common thread that underlies most customer service improvements. Efficient, seamless customer communication makes the difference.

When customers can get answers to questions quickly, request technical support, and more without having to wait for response from customer service or navigate complicated phone queues, life is better.

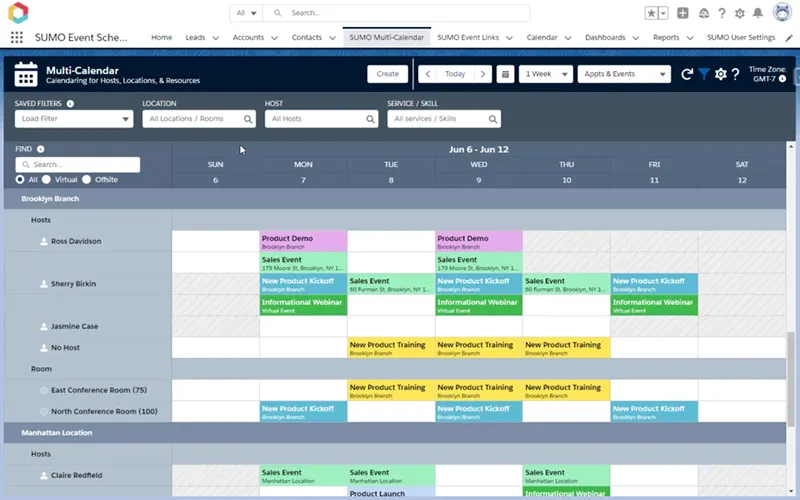

How does SUMO help companies improve the customer experience? Consider the experience of one of our large customers, a multinational healthcare insurance provider with 2.9 million members. As a result, customers can make appointments with the company that suits their schedule and receive appointment reminders.

Discover how your sales and customer service can improve customer service with every customer by contacting SUMO today.