Today’s consumer behavior has undoubtedly changed in the way people interact, work, and shop. As global financial institutions continue to adapt to new economic trends, they are using an omni-channel approach to ensure a customer-centric focus on business. How will financial service providers adjust their customer success strategy to meet the demands of today’s world? What engagement tactics will they use to ensure customer satisfaction and retention?

This article offers insight into possible developments and suggests methods that can help your company remain at the forefront of customer success and innovation.

Navigating The Change

With physical distancing affecting every aspect of today’s life, consumers are getting used to the idea of doing business remotely. They are more comfortable using online services and mobile apps to engage with financial institutions and will be doing so in the future. According to a recent study by The Financial Brand, 31% of 1,000 American consumers indicated they will continue to rely on online payment systems and mobile banking for their financial needs. 45% of the survey respondents prefer mobile wallet platforms as they move away from using cash and going into physical locations.

Another recent study by McKinsey indicates consumer willingness to reduce in-person purchases, cash transactions, and ATM usage. It anticipates a future shift from physical to virtual banking. As a result, financial companies will be required to adopt real-time payment infrastructures and other personalized technologies that help create a stellar customer experience.

It’s clear that a successful customer engagement strategy largely depends on the technology a company chooses to implement. Even customers who were reluctant to use apps and software in the past are now gaining comfort and confidence with this next wave of digital transformation.

Although most cutting-edge technologies are quite mature and are readily available, it takes knowledge and a creative approach to implement them. Let’s take a look at a few innovative ways in which you can adopt customer-centric technologies and ensure continuous business improvement.

How to Engage with Customers through Technology

1. Opt-in for Contactless Banking Solutions

With physical distancing paving the way to increased demand for remote interactions, contactless payments are becoming widely adopted by consumers around the world:

- Over 51% of Americans are now using mobile wallets like Google and Apple Pay

- MasterCard saw a 40% increase in contactless payments since the beginning of 2020

- Global contactless growth is anticipated to reach 19.8% year-over-year by 2027

Clearly, contactless payments are here to stay as consumers continue to apply a more focused approach to purchasing. Selecting a contactless banking solution that enables digital onboarding and secure authentication, facial and voice recognition, as well as fast payment processing, will help satisfy the demand for remote interactions and will increase customer retention.

2. Focus on Virtual Customer Servicing

Chats and voice bots have been around for a long time. Today, they are becoming increasingly important due to their ability to handle a large volume of customer requests in a physically distributed environment. If your company relies on remote call centers, you can leverage services such as virtual and in-person appointment scheduling, virtual queue management and virtual events to manage all types of customer requests, from simple queries to the most complex issues.

Industry leaders such as Bank of America and Capital One are already evolving their chats and voice bots into advanced “virtual assistants” that can send alerts and payment reminders, provide financial tips, recommend products, and ultimately help customers manage their finances better. By using predictive analytics and proactive algorithms, virtual customer servicing will soon become a go-to solution for personalized financial experience and innovative banking.

3. Find the Right Omni-Channel Customer Engagement Platform

It’s no surprise that consumers are becoming much savvier in the ways they interact with financial institutions. With the continuous shift toward digital transformation, your customers are more aligned with technology and innovation than ever before. Choosing the right omni-channel engagement platform to drive meaningful customer interactions will help to increase brand loyalty.

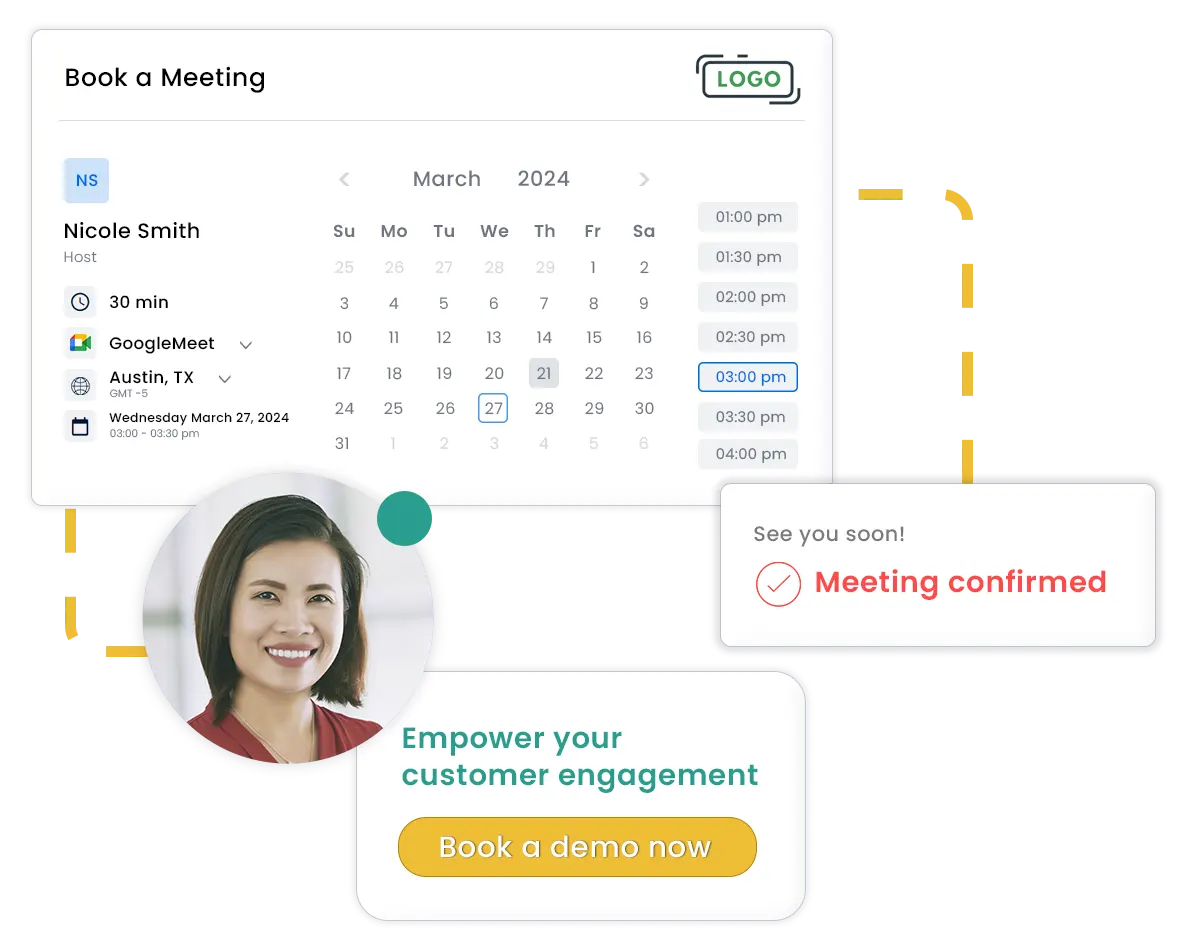

In the context of the “new normal”, superior customer experience means clarity, fulfilled expectations, and improved retention rates. The right platform leverages an interconnected set of communication and scheduling tools that drive an improved customer journey across digital channels, remote locations, and call centers. A robust customer engagement platform will also help you offer a personalized experience that connects customers with experts and services in the right place at the right time. Above all, it will help you earn customer loyalty, generate more business, and improve the quality of your services.

4. Offer Secure Remote Access to Your Employees

A recent study by MIT shows that roughly half of the US workforce is now working remotely. Furthermore, many tech companies, including Facebook and Twitter, intend on allowing their teams to work from home permanently. As companies realize remote employment boosts productivity and reduces overhead, they will be driven to create a more robust and distributed virtual office environment.

To achieve this goal, the financial industry will be required to deploy innovative cloud-based technologies focused on business continuity, security, and collaboration. These solutions must ensure 24/7 access to critical systems such as Citrix and Microsoft Outlook and employ out-of-band authentication methods that minimize the risk of intrusions and cyber attacks. Using secure cloud-based technologies to support seamless access to systems will also help scale your business up or down depending on the transaction volumes.

5. Embrace Continuous Improvement and Efficiency

Finally, the economic uncertainties of today’s world challenged financial firms to maintain a delicate balance between successful customer service and operational efficiency. To increase efficiencies, companies can choose to employ digital self-service programs that are far less expensive than phone-based education and in-branch selling. Enabling self-service techniques helps capture a myriad of opportunities to engage with customers on a deeper level while maintaining high service success rates and improving the bottom line. For example, a well-organized and searchable help center content can assist in resolving issues and provide financial education even before the customer reaches live support.

An absence of a well-designed self-service strategy not only misses out on an opportunity to fully connect with your customer but it also makes it difficult to fully utilize existing technologies and improve critical metrics like share of wallet and efficiency ratios. This can be easily avoided by implementing self-service programs backed up by support content from major digital channels.

Conclusion

Today, banks and financial companies are at the forefront of change. In tough economic times, and beyond, they play an immediate role in helping customers make important financial decisions geared toward improving quality of life. With the main focus on providing superior customer experience, financial service companies that utilize the right customer engagement platforms can turn the tide and build the economy of the future. As a result, they can create a raving following of clients that are more loyal, use more products and services, and cost less to retain.

Here at SUMO, we offer a Customer Engagement Platform that helps drive customer conversations, improves communication and generates more business at the point of purchase:

- Personalized experience based on customer needs and communication expectations (email invites, “front of the line” and “we’ve been waiting for you” services)

- Improving in-branch customer journey with unique features (“Meet with an Expert”, Waitlist Manager, experiential marketing events)

- Customer engagement and data insights for making better data-driven decisions (analytics builder with unlimited reports, in-app analytics discussions, mobile access, and more)