Insurers Report That SUMO Adds Up to 50 Percent More Appointments to Agents’ Calendars.

ATLANTA, Jan. 29, 2019 /PRNewswire/ — As insurance providers continue to face pressure to adopt efficient, secure and cost-effective technologies to maintain their competitiveness, many are also looking for new ways to streamline the path to the customer. This is why the U.S. leader in voluntary insurance sales at the worksite has chosen SUMO Scheduler, the #1 online appointment-scheduling solution built native on the Salesforce CRM platform.

According to Deloitte, seven out of 10 insurance carriers are now using cloud computing in their business as an integral part of their technology environment and business platform strategies. SUMO runs in the cloud as a mobile-friendly, software-as-a-service solution.

“Our insurance clients are reporting that SUMO Scheduler is adding up to 50 percent more appointments to their insurance agents’ calendars,” said Jason North, CEO and founder of SUMO Scheduler. “As you can imagine, appointment automation helps improve employee productivity, customer satisfaction and, ultimately, drives revenue growth.”

Prior to becoming a SUMO user, the insurance provider had always serviced its corporate clients by having agents at their sites during open enrollment periods to meet with interested employees and assist with the enrollment process. However, appointments were either scheduled manually or walk-in employees were met with on a first-come, first-serve basis, which was inconvenient if the insurance representative was already in a meeting. The provider wanted a way to automate appointment scheduling to improve customer service and engagement, and to ensure that the right number of agents are available on-site to handle needs.

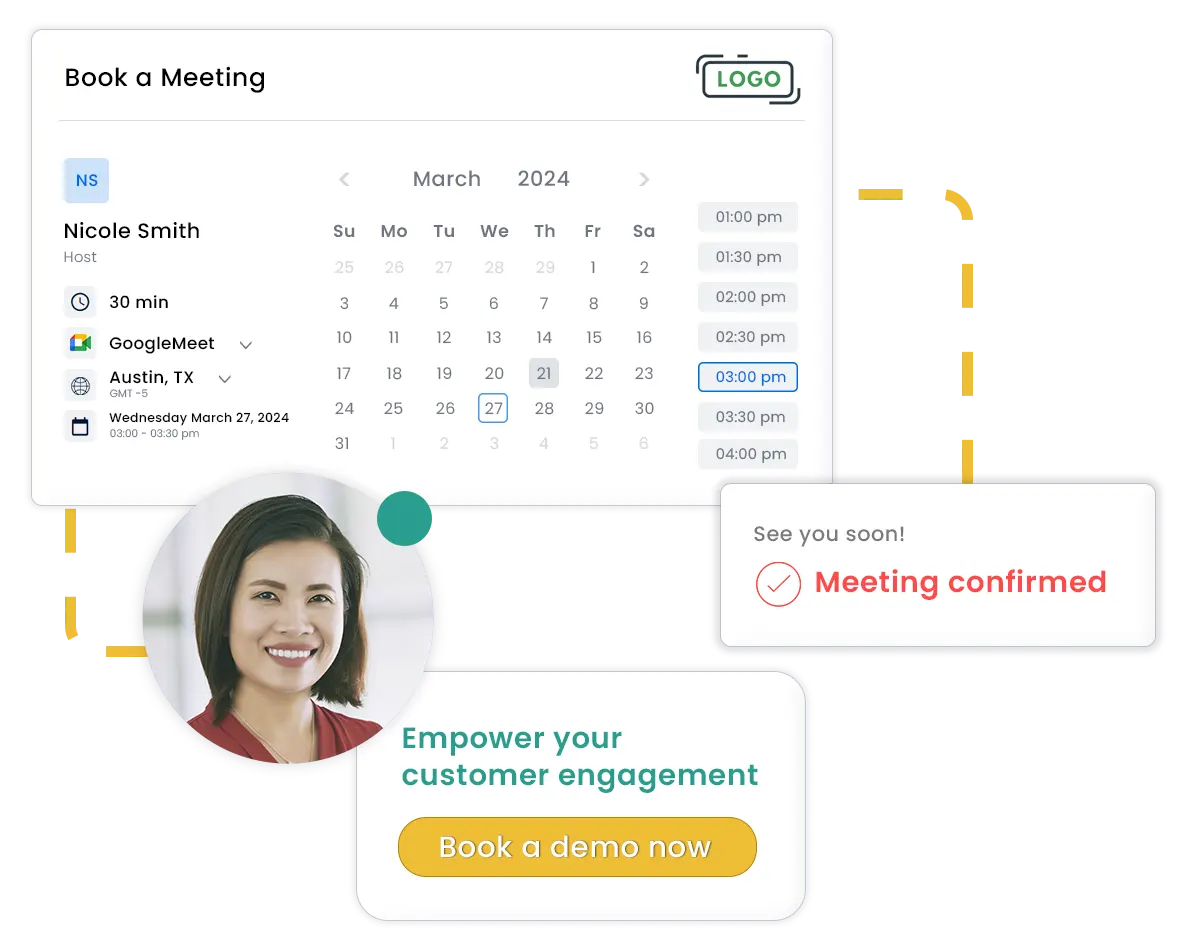

SUMO provides the insurer with the ability to offer self-scheduling to their corporate customers. A self-scheduling link, shared with their employees, enables them to schedule an appointment directly on an agent’s calendar when it is convenient for them during the time the agent will be on-site for annual open enrollment periods. Automated reminders sent directly to the employee from the insurance agent help to ensure that they do not miss their appointment. SUMO further enables the insurance provider to pair specific agents with employees based on questions or needs, so that they get the expert assistance they require.

“Many of our clients’ core strategies in 2019 are to modernize customer engagements to drive revenue growth,” said Jason North. “A key tactic our customers are deploying to attract and retain customers is to offer Schedule Now technology to connect customers with experts fast. It only takes a moment to lose a customer, so streamlining the path to a conversation is absolutely key and the solution must be mobile friendly.”

To schedule a call with a scheduling expert at SUMO Scheduler, go here.