Warren Buffet prioritizes time management above all else. Here’s how his (and your) Bank can do the same with Schedulers.

When asked in business school about what the most valuable asset for a company is,

a majority of students usually respond with money or capital. While both answers are fine, the true asset of any organization, company or institution around the world is time.

Warren Buffett, currently the fifth richest man in the world according to Forbes, once quoted that “the rich invest in time; the poor invest in money”, recommending the strategic use of our time to better organize and manage our business objectives.

For professionals working in Banking, time is (literally) a commodity that can either improve or impair day-to-day operations, depending on how well it is saved, redistributed and prioritized.

Let’s look at how the dynamic world of banking operates, and what can be done to improve a Bank’s time management, efficiency, and data security practices through industry-leading solutions.

Why is Time Scheduling Important in Banking?

Across multiple apartments, roles and responsibilities within a Bank, time management and scheduling are factors which help efficiently conduct day-to-day business.

A Bank Teller is responsible for helping members cash checks, withdraw money, move transactions to different accounts, and much more. This position requires the professional to be strict with time, and utilize time-sensitive methods to assist as many clients as possible.

Bankers are in charge of meeting with bank stakeholders (both individual clients or enterprises) and helping them acquire assistance such as how and when to schedule follow up appointments regarding loans. As the bulk of their day is spent meeting appointments, having a meeting scheduler greatly enhances their efficiency.

(Mortgage) Consultants help companies or individuals identify their (mortgage) needs, by assessing their financial records, inflow and outflow of finances. Similarly to Bankers, they require a well-managed and tightly-organized schedule to efficiently handle their clientele.

Bank Managers are in charge of efficiently handling administration, operations, communication, training, and security within a branch, a role that requires them to be efficient with their time management and meeting prioritization.

A Financial Advisor’s priority is to maintain relationships with clients as he/she meets with clients on a regular basis to ensure their portfolio is meeting financial goals. Therefore, smart time management is of immense value when managing a variety of customers and portfolios.

Insurance Brokers are responsible for finding new customers, promoting and selling our insurance plans. Since their goal is to steadily forge long-term relationships to secure the company’s revenues and growth, they focus their efforts on attracting new clients by inviting them to virtual or in person financial planning events.

Merchant Services Specialists are in charge of processing services that enable a business to accept a transaction payment through a secure (encrypted) channel. Thus, they hold a highly important responsibility that requires onboarding meetings with potential customers who purchase payment, loan, or line of credit products.

Across its multiple departments, from operation responsibilities to technical ones, a well-managed scheduler can not only enhance employee productivity, but maximize the efficiency of the Bank, improving its value as a whole.

Benefits of a Scheduler for Banking:

With a time-sensitive profession focused on the efficient handling of sensitive resources, a Bank’s internal ecosystem can greatly benefit from using modern, technological, and secure solutions, such as Schedulers.

Here’s how a Scheduler can assist the aforementioned bank employees in their day-to-day operations:

- Bank Tellers can use the highly configurable “smart matching” systems that match specific customers with the right teller, at the right time. For instance, If a client only communicates in Spanish and requires assistance, that client can simply choose a prompt in the sign-in system (ex: “spanish-language assistance”), and will then be added into the on-location waitlist of a teller that communicates in Spanish.

- Bankers can use a Scheduler to schedule any type of appointment: in-person, phone, video, and web conference, in advance. Say a client desires a meeting in three days from now but is not sure about the time; the Banker can immediately send a prompt through the Scheduler highlighting his (her/their) available hours, thus greatly reducing the need for back-and-forth correspondence.

- Consultants, who require regular contact with their client regardless of location, can smartly handle the time conversions by using support for GMT (Global Time Zones) or DST (Daylight Savings Time), reducing the risk of missed opportunities and providing their global clientele with consistent support.

- Bank Managers can quickly cut down on bureaucratic and organizational challenges by automatically insert web conference details into the calendar invitations, seamlessly setting up regular meetings with department heads and evenly managing each sector of their branch efficiently.

- Financial Advisors can take charge of multiple portfolios and support evolving needs by integrating the Scheduler into their Finance Cloud platform, or seamlessly integrate it with other solutions.

- Insurance Brokers can efficiently build long-term relationships with viable clients by managing an unlimited number of profiles and availability across multiple locations.

- Best of all, Salesforce Native Platforms are easy to implement & use, but if there is any assistance required, bank employees can quickly receive assistance from SUMO’s implementation and support team.

Additional Benefits for Salesforce Users:

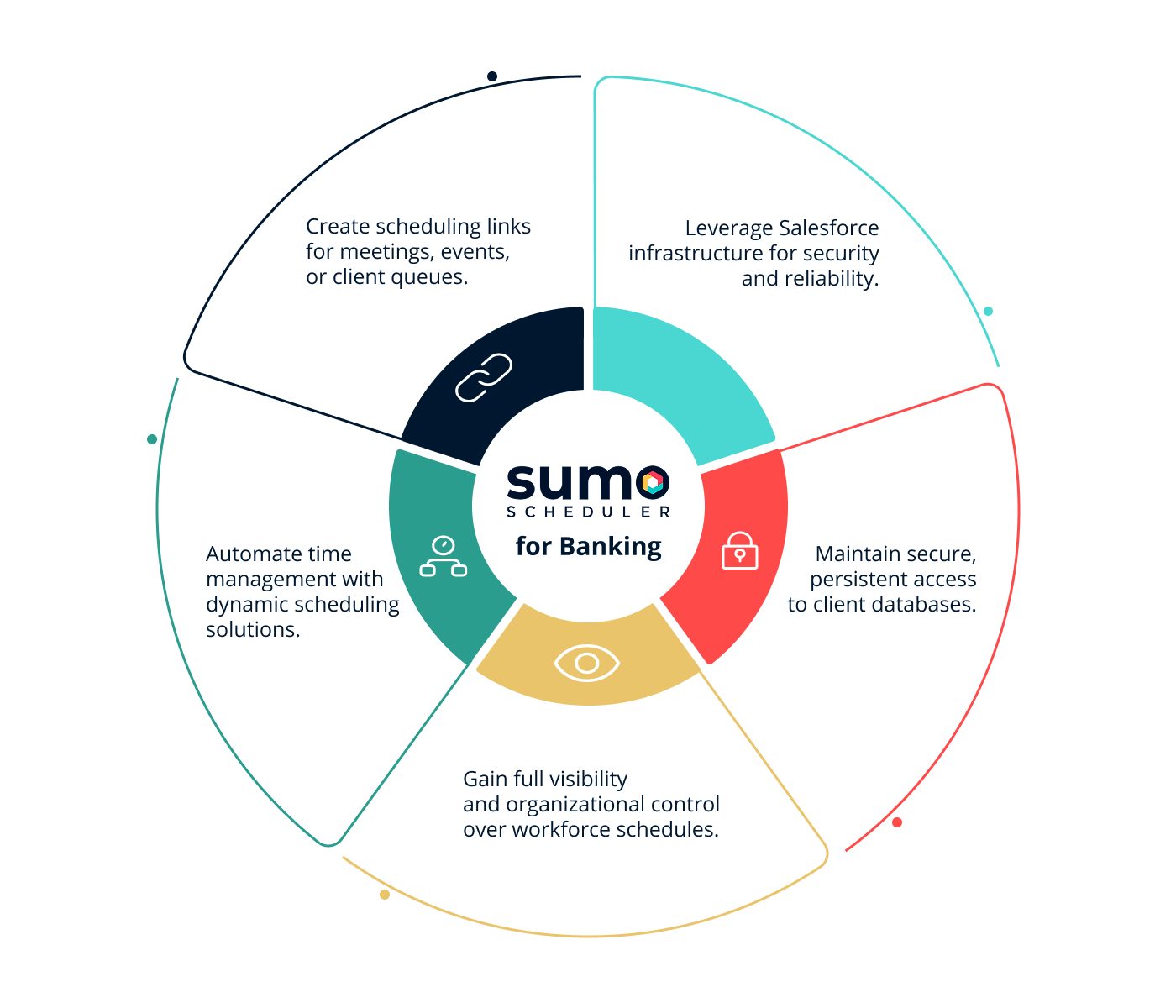

Additionally, for Salesforce users or administrators looking to run their business smoothly, an in-built, Salesforce native platform such as SUMO Scheduler can work to improve efficiency and cut down on lost time, by allowing them to:

- Create Rules & scheduling links for meetings, events, or client queues.

- Use the Salesforce Infrastructure, Security, and Reliability for their objectives

- Maintain a secure, persistent access with their client database.

- Gain complete visibility & organizational control over the entire workforce.

This, coupled with the previously-mentioned benefits, means that an all-in-one automated scheduling platform as SUMO Scheduler supports its users with a dynamic, round-the-clock time management software at their fingertips, with additional utilities and solutions for Banking services that you can learn more about here.

Data Security and Regulatory Compliance:

Data security is vital, especially in such a delicate sector such as Banking, where individual and organizational finance need to be safeguarded and protected against cyberattacks.

That is why, Transparency and Compliance are not only important, but absolutely essential.

The only data SUMO Scheduler stores using itsPublic API are free/busy appointment availability and user IDs, which can not be used to identify a SUMO user’s real contact details. The SUMO cloud platform uses “HTTPS only”, which means all data in transit uses TLS 1.0 (and higher) encryption.

SUMO has also put a ton of security features in the hands of its customers, enabling them to protect their account through two-factor authentication, account lockout, password policies, and more.

Finally, SUMO applications are hosted on the Salesforce.com and Amazon AWS platforms that are maintained with 100% uptime guarantee. Our infrastructure is classified with military grade security to guarantee our technology is protected against potential threats.

Get Started Today.

This global financial services client credits the SUMO Platform for helping them save up to 25% of the time by eliminating manual effort and minimizing scheduling errors.

This National Bank’s implementation of SUMO Scheduler allowed customers to schedule appointments with advisors at their convenience, increasing efficiency and positively affecting revenue.

Join these and 100s of other businesses that use SUMO Scheduler’s secure, reliable, and game-changing scheduling platform within the financial services.

Book your free demo to learn more about SUMO Scheduler, and always stay two steps ahead of everything that comes your way.