Did you know that the insurance and financial services industry makes up almost $2 trillion of the total U.S. GDP?

For context, a trillion has twelve (!) zeros.

As reported by Zippia, there are over 374,000 jobs currently available in the finance industry in the U.S. alone, while positions such as Financial Administrator, Transfers Supervisor, and Account Analyst are reported to earn up to $100,000 per year.

This, coupled with the international expansion of financial institutions such as Goldman Sachs and JP Morgan has increased the opportunities for an educated professional to earn a white-collar job in financial services across the world.

However, before embarking on a journey into the world of financial services, it is important to identify the key challenges currently faced by professionals within the industry, in order to be prepared and ready for the job.

Whether you are a bank manager, a customer team lead, or simply preparing for your interview, here are the most common issues that financial service professionals face.

Find out which key techniques, tools and software professionals use to stay on top of their day-to-day responsibilities.

What are Financial Services?

But, let’s start with the definition.

Financial services are a variety of economic services provided by the finance industry, which incorporate a broad range of service sector businesses that provide financial management.

The financial services can include solutions, such as:

- Private & Corporate Banking

- Taxes & Accounting

- Credit Cards or other Payment services

- Investment Funds

- Mortgages & Real Estate

These financials services are provided by the service sector businesses, which include

- Accounting Firms

- Funds and investment Corporations

- Insurance Companies

- Brokerage Firms

- Central Banks/Retail Banks

- Credit Unions

And within the above-mentioned service sector businesses are professionals that, through little fault of their own, face similar day-to-day challenges related to time mismanagement, lack of communication, and technology adaptation, among others.

Challenges Within the FinServ Industry

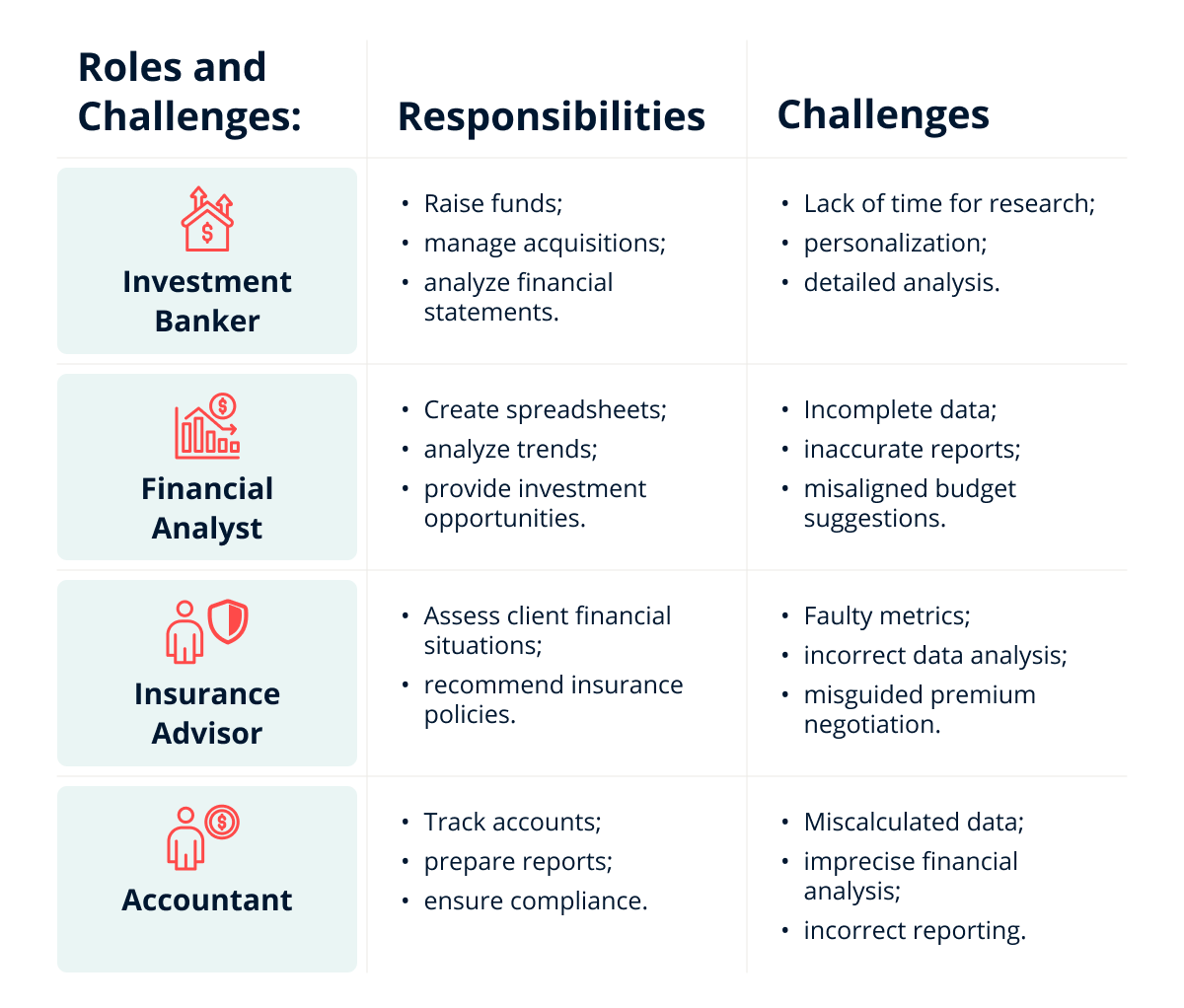

Let’s look at the four most prominent job positions among financial sector businesses in the U.S., their key responsibilities, and the challenges they can face.

Investment Banker

According to Investopedia, investment bankers are financial advisors who help their clients raise money through actions such as issuing stocks, negotiating the acquisition of a rival company, or arranging the sale of company assets, among others.

Investment Bankers are put in charge of multiple clients at once, and are required to conduct time-sensitive tasks efficiently, a lack of which can lead to a snowball effect, such as:

→ Lack of time to conduct in-depth industry research

→ Lack of time to invest in a personalized experience with the client

→ Lack of detailed analysis of the clients’ financial statements

→ Lack of time to develop investment solutions for the client

Financial Analyst

According to Robert Half, A Financial Analyst is responsible for the key financial planning and analysis of a company, allowing the organization to make well-informed decisions.

They deal with sensitive business data, and are tasked with creating detailed spreadsheets, providing investment opportunities, and developing lucrative growth policies.

Thus, a Financial Analyst’s responsibilities can be jeopardized if the core data used to create solutions is incomplete or lacking information from a business channel, which can lead to:

→ Incomplete spreadsheets with partially-missing key data

→ Incorrect financial performance and trend reports

→ Misaligned suggestions regarding budgets and improvements

→ Inaccurate investment opportunities presented to the client

Insurance Advisor

Adroit Insurance defines the key responsibility of Insurance advisors as such;

Individuals that are responsible for advising clients on how to protect against risk.

These Advisors work with clients to assess their financial situation and analyze information to implement suitable insurance policies on behalf of the client.

Since Advisors are tasked with improving financial results, and are thus required to drive key metrics such as conversions and revenue, the portfolio of a client must be meticulously analyzed. A lack of clear analysis can lead to situations such as:

- Faulty conversion metrics from the client’s financial portfolios

- Incorrect capture of results from the wrong metrics

- Erroneous data analysis and reporting

- Misguided attempt to negotiate new insurance premiums

Accountant

Accountants are in charge of analyzing a company’s accounts and ensuring compliance with financial regulations of the region. According to Indeed, an Accountant’s tasks revolve around preparing financial reports that track a client’s assets, liabilities, profit and loss,

tax details, and other related financial activities necessary for accurate analysis.

Since factual data is so vital to an Accountant, a lack of such can have disastrous consequences for the firm (and the client), as exemplified below:

→ Miscalculated data from bank statements and bookkeeping ledgers

→ Incorrect analysis of the client’s expenditures

→ Imprecise reporting of client’s income and expenditure data

→ Inaccurate analysis of client’s overall company finances

Solutions backed by Technology and Results

As explained above, even the most experienced professionals within the FinServ industry can struggle with tasks due to a lack of proper time management or an unnecessary workload of manual processes…. Something that Scheduling Softwares help with.

SUMO Scheduler is a powerful scheduling software that automates record creation and maximizes performance. The Online Appointment Scheduler allows clients to book appointments at their leisure while guaranteeing that the meeting would take place at the correct time with the correct professional that meets the specific needs of the client.

With Appointment Scheduling, organizations can automate tasks such as phone call reminders, email confirmations, SMS notifications, and automate follow-up for unconfirmed appointments.

Thus, clients with an Omnichannel strategy receive accurate metrics across all digital and physical properties, including website, social media, retail locations, call centers, email signatures, and more.

Take the Next Step Towards Success

In conclusion, the use of a Scheduling Software for the previously mentioned roles can help in this way:

More time for Investment Bankers to to focus on the client’s personalized needs

More detailed data points for Analysts to study and recommend growth opportunities

More focused metrics for Insurance Advisors to suggest better insurance premiums

More accurate data for Accountants to report to the client

This global financial services client credits the SUMO Platform for helping them save up to 25% of the time by eliminating manual effort and minimizing scheduling errors.

This National Bank’s implementation of SUMO Scheduler allowed customers to schedule appointments with advisors at their convenience, increasing efficiency and positively affecting revenue.

Join 100s of other businesses that use SUMO Scheduler’s secure, reliable, and game-changing scheduling platform within the financial services.

Book your free demo to learn more about Scheduling Softwares, and learn how SUMO Scheduler can help you and your financial institution thrive.