Customer engagement and appointment scheduling apps now help to keep customer service running smoothly as branches adjust to meet changing consumer demands. The apps show their ability to offer more personalization, while adapting to consumers safety needs.

No one could have predicted how retail banking could be turned upside down in just a matter of a few weeks. The entire country started to practice social isolation to limit the spread of the COVID-19 virus, followed by strict stay-at -home rules implemented by several states and cities in close succession.

Of course, the need for financial transactions continues as consumers pivot to working from the safety of their homes.

Banks, financial services organizations, and credit unions are rapidly adapting to consumer needs to tackle the unexpected crisis and to keep their retail operations stable and growing. Financial institutions of all sizes have cut walk-in visits, and are relying on teller and private appointments only.

New Protocol is to Limit In-Person Visits & Offer Virtual Options

Converting from a walk-in model to “by appointment-only” is essential to guard consumers’ safety, while servicing their needs.

The “by appointment only” model has a number of advantages for financial institutions. One example is to use SUMO Scheduler’s Analytics Builder to monitor the volume and service type of branch traffic. With this understanding, you are able to guarantee that staffing levels and skill training match consumer demand on a branch-by-branch basis. In a fast changing environment, this is particularly critical to monitor, in order to adjust week to week. Furthermore, financial institutions are limiting the number of consumers onsite to comply with social distancing requirements and staffing accordingly.

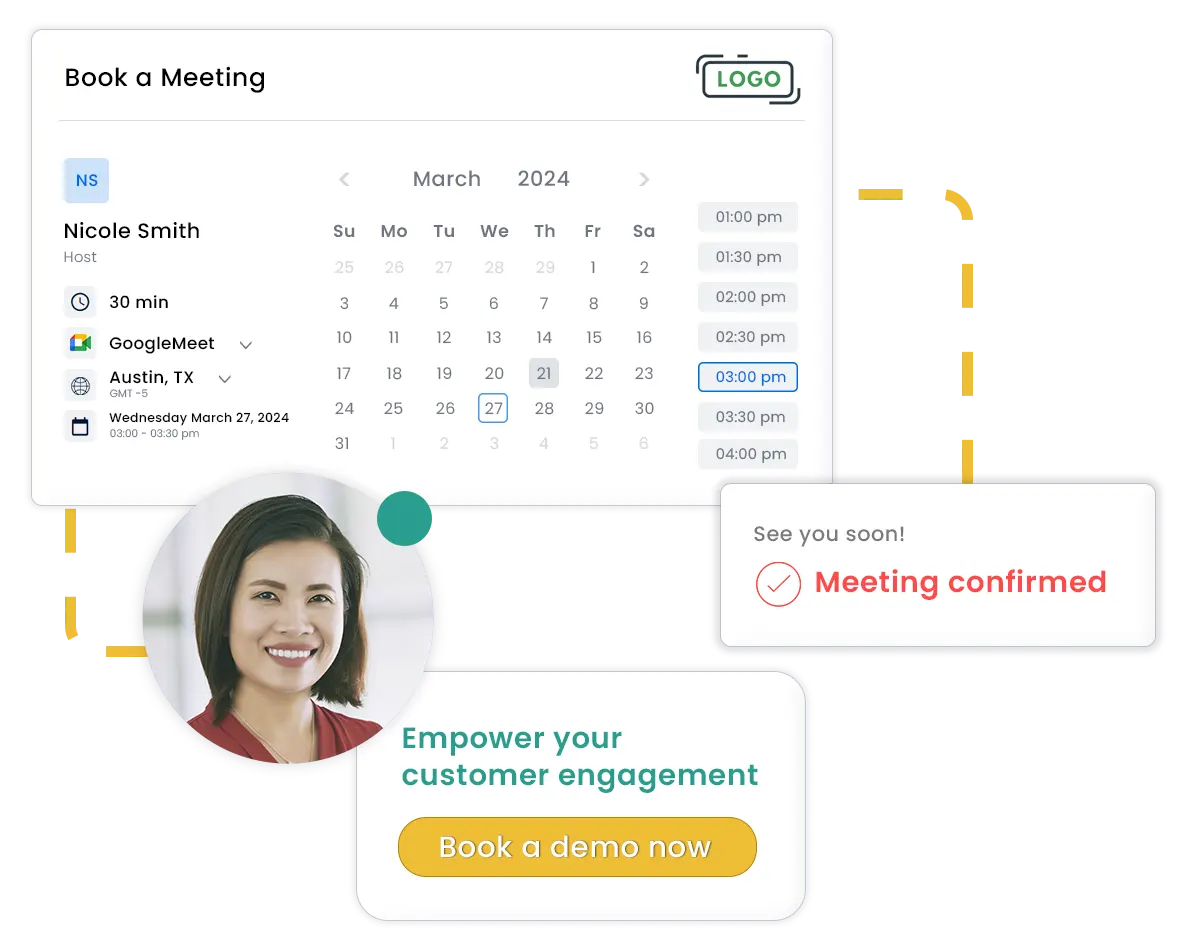

Another option that is in high demand, is offering virtual options. In the past few months, we’ve seen our financial institution customers more than double their “Virtual Consultations” using SUMO Scheduler’s Online Scheduler, by offering appointment scheduling for video or phone conference calls via their website and mobile apps. The Online Scheduler automatically matches the customer with the right banker, at the right location, at the right time, and auto-adds the video or phone conference details.

“SUMO Scheduler’s online scheduler has proven pivotal in helping keep our customers happy and operations running smoothly. Configuring the online scheduler to limit in-person appointments with buffers and turn on Virtual Appointments was simple and enabled us to adapt quickly. Honestly, I can’t even imagine how we would be surviving right now without SUMO’s appointment automation.” states a VP of a large U.S. Bank.

Purchasing & Engagement Data is Root of Personalization

Financial institutions benefit from understanding the historical needs of their customers. Why did the consumer schedule this appointment, what were their previous needs, we’re they met or are they still outstanding? Data gathered from SUMO Scheduler, gives bankers the capability to offer more personalized experiences, necessary to deliver and keep customers happy.

Anticipating consumer needs and matchmaking them with the right specialist, at the right location, at the right time vastly helps to efficiently deliver fast personalized solutions. This is also important to ensure regulatory compliance is met for more complicated banking products, such as mortgages and loans.

Having the capability to aggregate appointment data and identity trends at the brand, regional, or national level is critical in staffing consumer needs as they evolve through this coronavirus pandemic.

The Future After the Pandemic

It’s uncertain when or if the world will return to “normal”. Leading experts believe that when the current challenges of the pandemic are behind us, a new normal will emerge of how consumers engage financial institutions and retail.

For the past several years, there’s no denying the growing trend to engage customers in more personalized and meaningful ways both online and in person. It’s believed this priority will continue to grow in order to continue to attract and retain customers post-COVID-19.

Deloitte’s 2019 Banking Industry Outlook report confirms the trend to digital will continue, stating: “The importance of the branch in attracting and retaining customers, contrary to conventional wisdom, should remain…branches will continue to have value, especially with greater digital enablement”. Deloitte goes on to state how customers are likely to increase use if they offered more virtual services:

- Extended service hours through virtual remote services with a representative 36%

- Ability to schedule a personal appointment for a virtual video meeting with a representative 31%

Regarding future customer engagement models, it’s clear brand loyalty is being driven by consumers’ expectation of both personalization through matchmaking with specialists and flexibility to choose Virtual or limited In-Person meetings, all of which SUMO Scheduler excels at.