In 2025, banks need to act fast, know their customers, and be helpful from the very first interaction no matter where it happens online. But many banks still rely on outdated systems that make even simple tasks like scheduling a meeting, getting a consultation, or resolving an issue a frustrating quest. That’s where AI can help.

In this blog post, we’ll look at how AI is helping banks improve customer engagement and deliver smarter, more connected digital experiences. You’ll learn what AI agents banks and financial service providers can use (right now) to automate scheduling, support customers, and improve service across every channel.

Key Takeaways

- Customers want fast, human-like digital service but most banks still make it hard to book, chat, or follow up without friction. Outdated systems and long wait times are driving customers away.

- AI agents help banks deliver better customer experiences across the entire journey—from the very first conversation with an AI chat to the final follow-up that keeps customers engaged and satisfied.

- When AI handles low-value tasks like FAQs and reminders, your staff can spend more time advising and building trust for long-term loyalty.

- SUMO’s AI agents for banks manage appointment booking, meeting prep, and follow-ups, so customers get smoother service, and staff spend less time on repetitive tasks—leading to better customer outcomes.

Where Banks Are Falling Short in Customer Engagement

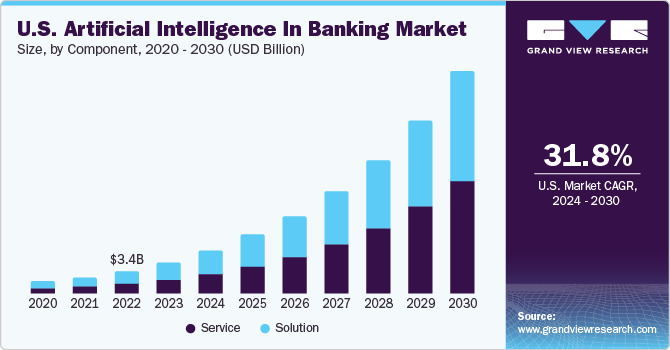

The global AI in banking market was worth $19.87 billion in 2023 and is projected to reach $143.56 billion by 2030—growing at a rate of 31.8% per year. This surge shows just how quickly AI is transforming banking, making it digital-first and customer-focused.

But while technology advances, customer expectations have also evolved.

Customers have no time or desire to wait in line at a branch or click through endless tabs just to talk to someone who can consult them on a loan. Instead, they want a digital experience that feels like the “older days”—as if they’re speaking to a trusted branch manager who knows their name, understands their needs, and can quickly guide them to the right solution.

Delivering that kind of experience is still a challenge for many banks. Here’s where the cracks are showing:

Booking a Meeting or Reaching Human Feels Like a Maze

When you need to book an appointment with a financial advisor or loan officer, the first thing that often comes to mind is calling your bank or credit union. That’s how it’s traditionally been done, and it’s still the default for many. But it’s also one of the most frustrating experiences. Just think of that on-hold music and the time you waste just trying to get to the right person.

If booking a meeting requires calling a branch, waiting on hold, or navigating a clunky website, many customers won’t follow through. And every dropped interaction is a missed opportunity for banks and a negative experience for customers.

Also Read: Enhancing Banking Efficiency with Online Scheduling

Legacy Systems Make Banks Feel Stuck in the Past

Many banks still run on legacy CRMs and support tools that lack integration with AI, automation, or real-time analytics. That makes it hard to scale personalization or act quickly. What’s more, the outdated, rigid systems make it complicated for customers to access the service they need.

Over half of consumers (61%) find it easier to sign up for a rewards program at their favorite store than to apply for a new credit card or a loan.

Low-Value Queries Drain Resources—High-Value Ones Go Unanswered

Support reps and call center agents in the banking and financial services sector spend most of their time on repeat tasks and answering FAQs. They guide customers on checking their account balances, resetting passwords, rescheduling appointments, or answering basic loan questions.

All these queries are important, yet they are considered low-value now, as they can all be automated with AI. It’s more productive to invest your team’s capacity into what really matters, e.g., helping a small business navigate loan options or resolving a complaint from a high-value customer.

When Banks Are Slow to Respond, Customers Walk Away

Today’s customer doesn’t wait. If someone applies for a credit card, sends a support request, or asks about a loan, they expect an immediate response. And if they don’t hear back, they won’t hesitate to go elsewhere.

In fact, it takes just one bad experience with your brand to lose 32% of your customers (PwC). Long hold times or emails ignored for days after generic auto-responses can push people to competitors who respond instantly.

Given that everything else in the world—from shopping to healthcare—is instant, banking must catch up or be left behind.

Customers Want Digital-First. Banks Are Trying to Keep Up

A study by Salesforce found that 53% of financial customers would switch providers for better digital experiences. When users can’t get the help they need quickly and easily, they switch banks—especially younger generations used to digital-first service in every other aspect of life.

With many banks still relying on clunky websites, outdated phone trees, and limited hours, these experiences don’t meet modern expectations.

Top 5 AI Agents for Banks That Empower Better Customer Engagement & Service

Gartner’s analysis in its report “Top Strategic Technology Trends for 2025,” highlights agentic AI as #1 transformative force set to reshape enterprise technology landscapes over the next 24 months.

AI agents today can help banks improve service, reduce operational costs, and build stronger client relationships by enabling smarter and more convenient digital experience. Here are the most hot AI use cases the banking industry can adopt to improve customer engagement and service.

#1. AI Scheduling Agents For Fast & Productive Appointments

Still asking customers to call or wait for a confirmation just to book a meeting? That’s costing you time and their patience.

AI appointment scheduling makes it easy for people to book time with the right person in just a few clicks. Whether it’s through your website, app, or chatbot, customers can choose a service, view real-time availability, and lock in a time that works—no back-and-forth, no hold music.

Here’s how banks and financial services use it:

- Service Requests: Book time for account setup, card issues, or general support.

- Loans & Mortgages: Let customers meet with a loan officer to apply or refinance.

- Investments: Schedule reviews or planning sessions with a financial advisor.

- Loan Processing: Set appointments to collect documents or finalize approvals.

- Branch Visits: Match clients with the right location and staff member based on their need.

You can also route clients based on expertise—for example, small business owners looking for capital can be sent directly to the right advisor.

Also Read: How AI Appointment Scheduling Drives ROI: Use Cases Explained

Why AI scheduling matters for banks:

- High-value appointments are not missed

- Automation ensures the most effective resource allocation

- Your staff spends less time coordinating, more time helping

- Customers feel taken care of—and keep coming back

SUMO’s AI appointment scheduling for banks is a simple upgrade that saves time, reduces friction, and keeps your schedule full.

Explore how SUMO’s AI engagement agents help banks deliver faster, smarter service

#2. Conversational AI Chatbots For Human-Like Interactions

Most chatbots fail because they don’t really listen. They follow scripts, miss context, and leave customers repeating themselves. In 2025, that’s not good enough.

AI-powered chat is getting smarter. SUMO’s conversational AI website agent can guide customers on a better service, spot intent to meet and suggest optimal time taking into account your team’s real-time availability and location, guide on directions and document handling and other tasks—just like a helpful advisor would.

Here’s what that looks like:

- You start a chat about investment options.

- The AI sees you recently got a bonus and changed jobs.

- It suggests speaking with a wealth manager and schedules a meeting when it suits you

- AI shares your info so the advisor is prepped before the call.

These AI agents can also:

- Recommend banking services based on what you’re asking

- Recall your history across chats, so you don’t have to repeat yourself

- Route you to a real person when needed—without starting over

- Support human agents by summarizing past chats and suggesting next steps in real time

Instead of feeling like you’re talking to a bot, it feels more like texting your banker.

The business impact:

- No friction via online channels

- Shorter wait times

- Less manual work for your team

- Smarter, faster, more personal support

- Happier customers who come back

A recent example: In 2023, Kasisto launched KAI-GPT—a large language model built specifically for banking. It powers KAI Answers, a tool that helps frontline staff quickly respond to customer questions with accurate, natural-sounding replies. The result: faster service and better support, without the wait.

The key is intent. If the AI knows what the customer wants, it can complete the task or smoothly hand things off to the right person. Either way, the experience stays seamless.

#3. AI Agents That Prepares Your Team For Financial Meeting

AI isn’t just good at scheduling and support—it makes sure your team shows up prepared. Before a client meeting, SUMO’s AI Call Planner agent can pull together a quick summary of that person’s financial and interaction history, map key questions to answer, and actions to take. No digging through notes or old emails.

So instead of wasting productive time asking repetitive questions, your bankers can get straight to what matters: giving good advice.

The result?

- More trust in less time

- Better conversations

- More conversions and upsell opportunities

#4. AI Note Takers To Summarize Your Financial Calls

Financial conversations are full of numbers. Instead of scribbling notes while trying to follow the conversation, your advisors can actually focus on the client while an AI note taking assistant listens, captures, and summarizes the details in real time.

SUMO’s AI Note Taker automatically joins scheduled financial calls (Zoom, MS Teams, or in-person synced via calendar), records the discussion, and produces:

- A clear meeting summary with key takeaways and action items

- Speaker-separated transcripts for compliance and coaching

- CRM-ready notes that can be pushed directly into Salesforce

- Next-step suggestions, follow-up reminders, and smart tagging

Whether it’s a loan consultation, portfolio review, or onboarding session, SUMO makes sure nothing falls through the cracks.

How AI note taking benefits banks & financial service providers:

- AI captures and reminds you of to-dos

- All vital meeting details are ready the moment the meeting ends

- No need to rely on memory or handwritten scribbles

- Full transcripts help with audits and advisor coaching

- Advisors spend less time on followups yet keep it personalized and impactful

Also Read: How AI Note Takers Help Teams Work Smarter

#5. AI Agents That Follow Up (So You Don’t Miss a Beat)

Many deals fall through because no one followed up. AI can fix that by sending reminders, confirmations, and nudges—automatically.

Examples:

- “You didn’t finish your loan application. Want to pick a time to continue?”

- “Still thinking about that savings plan? Here’s a link to book a follow-up.”

These small touches lead to:

- Reduced no-shows and dropped appointments

- Better engagement throughout the customer journey

- Boost in completion of key actions like form submissions or document uploads

Wrapping Up: Using AI in Banking to Power End-to-End Customer Engagement

Today’s customers expect fast, seamless service from banks no matter where or how they reach you. AI agents help you deliver exactly that by connecting every step of the customer journey, from booking to follow-up.

Instead of juggling disconnected tools, using SUMO’s AI engagement assistants lets you elevate every step of the customer interaction. Whether customers reach out via your app, website, email, or chatbot, they should get the same smooth experience every time.

By combining smart scheduling, automated follow-ups, and meeting prep tools, your banking team—whether in customer success, support, or service—spends less time on admin and more time delivering value.